Understanding Crypto Taxes: How Bitpie Wallet Can Help Crypto Taxes Made Simple: How Bitpie Wallet Helps You Track & Report

Tax season can be confusing, especially when it comes to cryptocurrency. Many users don't realize that simply holding, trading, or spending crypto triggers taxable events, and keeping track of every transaction for your annual report is a headache. As someone who’s been navigating this space for years, I want to break down the basics and show you how the right tool can simplify the process.

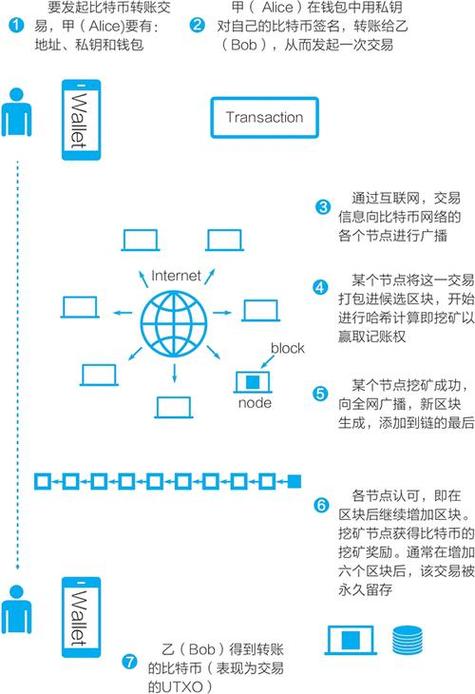

First, you need to understand what the taxman looks for. In most jurisdictions, disposing of an asset is a taxable event. This means selling crypto for fiat, trading one coin for another, or even using it to buy a coffee. You’re required to calculate your capital gains or losses for each of these transactions,which involves tracking the original cost basis, the date of acquisition, and the fair market value at the time of the trade.

This is where using a non-custodial wallet like Bitpie becomes a game-changer. Instead of manually sifting through blockchain explorers, Bitpie allows you to export your complete transaction history with just a few clicks. You can typically download a CSV file containing all your trades, which you can then upload directly to popular crypto tax software like CoinTracking or Koinly. This automation cuts down hours of work and minimizes the risk of calculation errors.

Have you started preparing your crypto taxes yet? What’s the biggest challenge you’re facing with tracking your transactions? Let’s discuss it in the comments.